The INit API is a tool for those who want to work with the platform not only through the bot interface but also programmatically. Simply put, it’s a set of rules and commands that allows your applications or services to interact directly with INit: check balances, make transfers, exchange currencies, or even run AML checks.

This approach is particularly useful for businesses, exchanges, fintech solutions, or any service that requires the automation of cryptocurrency operations.

How it works

The INit API is built on REST principles and works through a secure connection. All requests and responses are transmitted in JSON format, and security is ensured through the HMAC-SHA256 signature algorithm.

Each user receives a pair of keys:

- Access Key — access identifier

- Secret Key — private key used to sign requests

Without these keys, no action can be performed via the API. For additional security, you can set IP restrictions (whitelist) so that no one can fake requests from unauthorized addresses.

What the API can do

Through the API, all the key functions of INit are available, but in a programmatic format. The main ones include:

- Balance — checking available funds in different currencies.

- Deposits and withdrawals — generating deposit addresses, creating withdrawal requests, and tracking their status.

- Internal Transfers — instant transfers between accounts without commissions and blockchain.

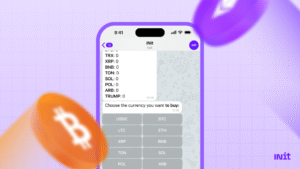

- Swaps — fast conversion of one currency into another at the current market rate.

- Limit Orders — the ability to buy or sell cryptocurrency at a price you specify. The order will execute automatically when the market reaches the required level.

- AML Checks — verifying addresses or transactions for money laundering, fraud, or suspicious activity. This is an important tool for businesses that comply with regulations.

Why this might be needed

The API opens the door to automation and scaling.

- For business: integrate payment solutions directly into your systems. For example, marketplaces or services can accept cryptocurrency payments, immediately check them for security, and withdraw them into fiat.

- For exchanges and fintech: create your own trading solutions, set up algorithmic strategies, or arbitrage.

- For teams and companies: keep records of funds, make internal transfers between accounts without extra costs.

- For compliance departments: conduct AML checks of clients or transactions to reduce the risk of blocking or fines.

- For developers: build custom applications or tools on top of INit, receiving data directly.

Advantages of using the API

- Speed — all operations are executed directly, without manual intervention.

- Flexibility — scenarios can be tailored to your business processes.

- Security — thanks to keys, IP restrictions, and two-factor authentication.

- Transparency — you can always check the status of every transaction or operation.

- Scalability — the API is suitable both for startups and for large companies processing thousands of operations.

Who this solution is for

- Financial services and exchangers looking to connect with cryptocurrency.

- B2B companies working with partners and needing fast internal settlements.

- Traders and investors who automate their trading strategies.

- Regulated companies that need to comply with AML/KYC requirements.

- Developers building their own fintech products.

Conclusion

The INit API is a bridge between your business or application and the entire cryptocurrency ecosystem. It allows you to work more efficiently, faster, and more securely.

Whether you run a large fintech or are building your own startup, the ability to integrate INit’s functions directly gives you the flexibility and control that are hard to achieve through.