“Zero fees.”

“Free swaps.”

“No commission.”

In crypto, free is one of the most powerful words in marketing. It promises frictionless access, fairness, and freedom from the hidden costs of traditional finance. But by 2026, most experienced users have learned an uncomfortable truth:

Nothing in crypto is truly free.

If a product doesn’t charge you directly, the cost is usually shifted somewhere else — into spreads, execution quality, hidden fees, or risk exposure. This article breaks down how “free” actually works in crypto products, who ends up paying, and why transparency is becoming one of the strongest competitive advantages in the industry.

1. Why “Free” Became a Crypto Obsession

Crypto emerged as a reaction to opaque financial systems:

- banks with unclear fees,

- intermediaries taking silent cuts,

- slow settlements,

- and limited user control.

So when crypto products started offering “free trading” or “zero fees,” it felt like progress. And for a while, it was.

But as products scaled and markets matured, a simple reality set in:

infrastructure costs money.

Nodes, liquidity, security, development, compliance, risk management — none of these disappear just because a UI says “$0 fee.”

The cost didn’t vanish.

It just became harder to see.

2. The Most Common Hidden Costs in Crypto

Let’s unpack where users actually pay when a product claims to be free.

Spreads Instead of Fees

Many platforms remove visible fees but widen the spread:

- you buy slightly higher,

- you sell slightly lower,

- the difference becomes the platform’s revenue.

This is especially common in:

- instant swap tools,

- simplified interfaces,

- retail-oriented products.

The user feels comfort (“no fee”), but the cost is embedded into the price.

Execution Quality

In fast markets, “free” often means:

- worse routing,

- shallow liquidity,

- higher slippage,

- delayed execution.

You don’t pay a fee —

you just get a worse outcome.

Over time, these small inefficiencies often cost more than a transparent commission ever would.

Hidden Network Costs

Some products advertise “free swaps” but pass:

- gas fees,

- routing costs,

- bridge fees

directly to the user — without clearly explaining how they’re calculated.

The transaction completes, but the final amount surprises the user.

Risk as a Cost

In some cases, “free” means:

- no AML screening,

- no counterparty checks,

- no transaction monitoring,

- no protective guardrails.

The platform saves money by cutting safety layers — and the user pays through higher exposure to risk. This cost only becomes visible when something goes wrong.

3. Who Actually Pays When Crypto Is “Free”?

The answer is simple, but uncomfortable: The user always pays — just not always immediately or visibly.

Sometimes the cost is:

- financial (worse price),

- structural (less protection),

- behavioral (trust erosion),

- or long-term (unexpected losses).

“Free” shifts the payment from a clear line item to a silent mechanism.

4. Why Users Are Starting to Notice

In 2026, user behavior is changing.

More people now:

- compare execution, not just fees,

- check final received amounts,

- ask how pricing is formed,

- care about transparency and auditability,

- prefer predictable costs over “magic zeroes.”

This shift is driven by experience. After a few confusing transactions, users realize: Clarity feels cheaper than surprises.

5. Transparency as a Competitive Advantage

In a crowded crypto market, transparency is no longer a “nice to have.”

It’s becoming a trust signal.

Transparent products:

- explain where fees come from,

- show how prices are calculated,

- separate platform fees from network costs,

- make trade-offs visible,

- treat users as decision-makers, not clickers.

This builds long-term trust — especially in environments where users act fast and mistakes are irreversible.

6. Why Clear Fees Are Better Than “No Fees”

A clear fee:

- can be compared,

- can be anticipated,

- can be optimized,

- and can be trusted.

A hidden cost:

- can’t be predicted,

- can’t be controlled,

- and often appears only after the transaction is done.

As crypto products move from experimentation to everyday use — payments, business flows, recurring actions — predictability matters more than illusion.

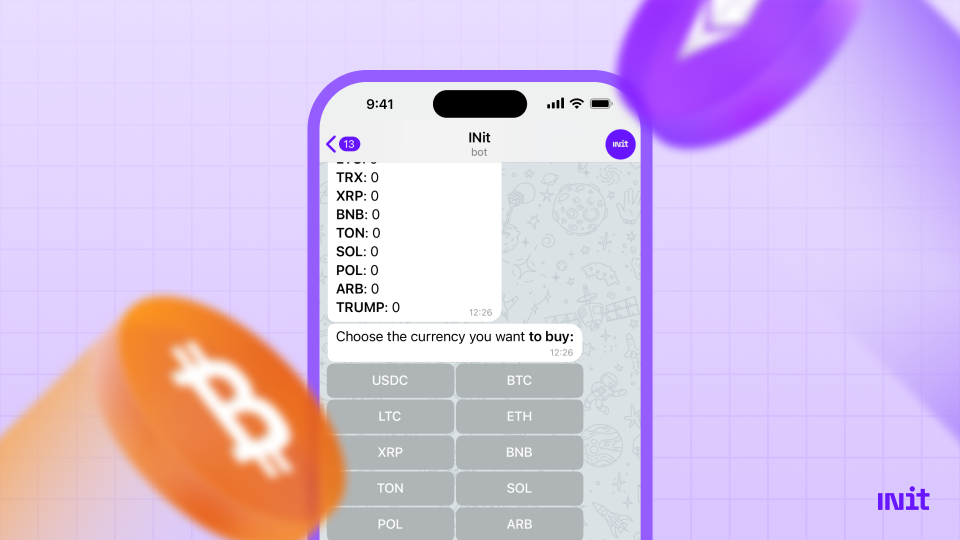

7. Where INit Takes a Different Approach

This is exactly where INit takes a different stance.

Instead of advertising “free” at all costs, INit focuses on:

- transparent fee structures,

- clear separation between platform fees and network costs,

- predictable execution logic,

- and user visibility into how each transaction is formed.

Users can:

- review fees directly in the bot,

- check them on the website,

- understand what they’re paying for before confirming an action.

There are no hidden spreads masked as convenience,

no surprise deductions after the fact.

The idea is simple:

if users understand the cost, they can decide if the value makes sense.

8. The Bigger Shift: From “Free” to “Fair”

Crypto is maturing.

The next phase isn’t about eliminating costs — it’s about making costs honest.

Products that win long-term will be the ones that:

- respect user intelligence,

- explain their economics,

- align incentives clearly,

- and remove ambiguity instead of hiding it.

“Free” attracts attention.

Transparency builds trust.

Final Thought

Every crypto product has a cost structure.

The only real question is whether it’s visible or hidden.

As users become more experienced and use crypto for real workflows — not just speculation — clarity will matter more than marketing slogans.

In that new reality, platforms that choose openness over illusion will stand out. And that’s the direction the industry is moving toward.