Crypto has always chased speed.

From Bitcoin’s 10-minute blocks to sub-second finality, the industry has treated faster transactions as unquestionable progress. “Instant” became a promise, a headline, and eventually an expectation.

But by 2025, a harder truth emerged:

speed without guardrails doesn’t just reduce friction — it amplifies risk.

As crypto moves from occasional transfers to everyday payments and business workflows, the cost of mistakes grows. When transactions are irreversible, “instant” stops being purely a benefit and starts becoming a liability.

1. Why Speed Became the Ultimate Selling Point

Speed solved real problems:

- long confirmation times,

- poor UX,

- failed payments,

- user frustration.

Faster networks lowered barriers and made crypto usable beyond enthusiasts. In many cases, speed enabled adoption.

But speed also removed pause points — moments where users could reconsider, verify, or correct mistakes.

In traditional finance, delays act as protection.

In crypto, speed removes that safety net.

2. What “Instant” Actually Means in Practice

“Instant” doesn’t always mean the same thing.

Sometimes it refers to:

- fast block times,

- optimistic confirmations,

- off-chain batching,

- or UI-level assumptions before final settlement.

The problem isn’t speed itself — it’s the illusion of finality.

Users often believe a transaction is complete when:

- it’s only broadcast,

- only partially confirmed,

- or settled optimistically but not finalized.

That gap is where risk lives.

3. The Real Risks of Instant Transactions

Speed increases exposure in several ways:

- Human error: wrong address, wrong amount, wrong chain

- Malicious activity: scams rely on urgency and lack of review

- Automation failures: bots executing incorrect logic at scale

- Compliance gaps: transactions moving before checks are complete

Once value moves instantly, recovery becomes nearly impossible.

In slow systems, mistakes are painful.

In instant systems, they’re final.

4. Why Guardrails Matter More Than Raw Speed

Guardrails don’t slow crypto down — they make speed usable.

They introduce:

- validation before execution,

- checks before confirmation,

- limits before damage escalates,

- and visibility before finality.

The goal isn’t to block users.

It’s to protect them from irreversible outcomes they didn’t intend.

5. Transaction Speed Across Networks (and Why It Varies)

Below is a simplified comparison showing how speed, finality, and risk differ across popular networks:

| Network | Avg. Confirmation Time | Finality Type | Speed Benefit | Risk Consideration |

|---|---|---|---|---|

| Bitcoin | ~10 minutes | Probabilistic | High security | Slow, but safest against reorgs |

| Ethereum | ~12 seconds | Probabilistic → Final | Balance of speed & safety | Reorg risk before finality |

| Solana | ~0.4 seconds | Fast probabilistic | Near-instant UX | Errors propagate quickly |

| TON | ~5 seconds | Fast finality | Smooth UX for payments | Needs strong validation |

| L2s (Optimistic) | Instant UX | Delayed finality | Very fast | Withdrawal & dispute delays |

Key insight:

The faster the network, the more important off-chain and application-level safeguards become.

6. What “Safe Speed” Actually Looks Like

Safe speed doesn’t mean slowing transactions.

It means controlling how and when they execute.

Effective guardrails include:

- address risk screening,

- transaction previews,

- dynamic limits,

- anomaly detection,

- delayed execution for unusual behavior,

- and clear user confirmations.

Speed without context is dangerous.

Speed with clarity is powerful.

7. Automation Without Guardrails Is a Multiplier of Risk

Automation accelerates everything — including mistakes.

A single incorrect rule can:

- trigger repeated transfers,

- amplify losses,

- or move funds faster than humans can react.

That’s why automation must be paired with:

- thresholds,

- monitoring,

- interrupt mechanisms,

- and human oversight.

Fast systems must be interruptible.

8. How Products Are Learning to Balance Speed and Safety

The industry is slowly shifting its mindset.

Instead of asking, “How fast can this be?”

Better products now ask, “How fast can this be safely?”

This leads to:

- smarter defaults,

- fewer irreversible clicks,

- better explanations at critical moments,

- and systems that pause when behavior looks abnormal.

Speed remains — but recklessness doesn’t.

9. Where INit Fits in This Balance

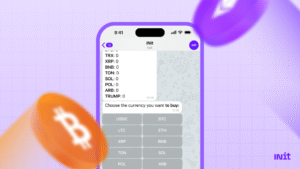

This balance between speed and safety is central to how INit approaches product design.

INit focuses on:

- fast execution with transparent logic,

- automated checks running in the background,

- clear transaction visibility before confirmation,

- limits that prevent accidental or risky behavior,

- and live human support when something feels off.

Instead of choosing between instant UX and protection, the goal is to combine both — so users move quickly without losing control.

10. The Bigger Picture: Crypto Is Becoming Operational

As crypto becomes part of daily life — payments, business flows, recurring actions — mistakes become more expensive.

Speed alone no longer wins trust.

Predictable safety does.

Products that survive will be those that:

- respect user intent,

- slow down when it matters,

- and stay fast where it’s truly safe.

Final Thought

“Instant” is powerful — but it’s not neutral.

In crypto, speed magnifies outcomes.

With guardrails, it enables adoption.

Without them, it accelerates loss.

The future of crypto isn’t slower transactions.

It’s smarter speed